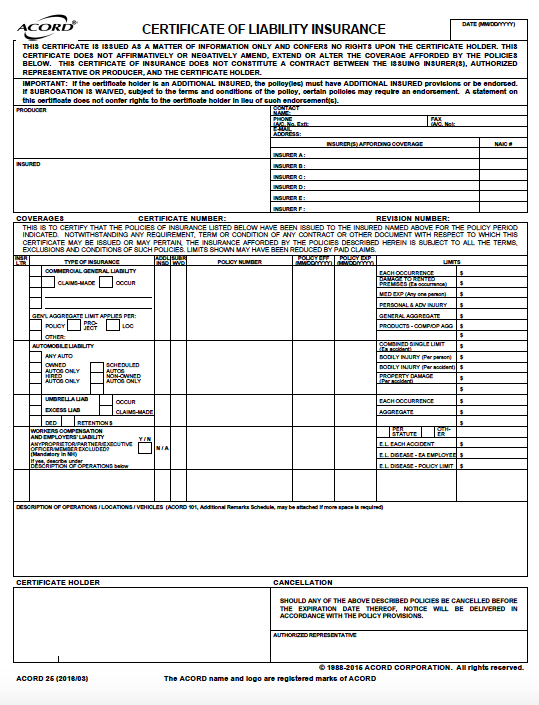

Instant Certificates of Insurance 24/7

Did you know that we makes it possible for our customers to issue their own Certificates of Insurance at any time, from anywhere, 24/7? You will be able to add a holder to a specific certificate, generate the certificate for that holder, and print or save it accordingly.

Business Insurance For Roofing Contractors

Get The Attention You Need Today!

We know it takes a lot of time and it's not easy to shop for roofers insurance. Who really has the best coverage and rates? And who has time to call around from company to company, spending hours searching for the best coverage? We make the process simple again.

Understanding Insurance Requirements for Texas Roofing Contractors

As a roofing contractor in Texas, having proper insurance coverage isn't just a good business practice—it's essential for protecting your livelihood, employees, and clients. The unique challenges of the roofing industry combined with Texas's severe weather conditions make comprehensive insurance coverage particularly important.

Why Roofer's Insurance Matters in Texas

Texas experiences some of the most extreme weather in the nation, from hailstorms and tornadoes to hurricanes along the Gulf Coast. These weather events create high demand for roofing services but also increase the risks roofing contractors face daily.

The Lone Star State sees more hail damage claims than any other state, with annual losses often exceeding $1 billion. For roofing contractors, this means both opportunity and risk—making proper insurance coverage critical to your business's sustainability.

Essential Insurance Coverage for Texas Roofers

General Liability Insurance

General liability insurance is the foundation of any roofer's insurance package. This coverage protects your business against third-party claims for:

- Property damage (such as accidentally damaging a client's landscaping)

- Bodily injury (if a client trips over your equipment)

- Completed operations (if your work causes issues after completion)

In Texas, where the climate can accelerate roof deterioration, completed operations coverage is particularly valuable. While the state doesn't mandate general liability insurance for roofers, most clients and general contractors will require proof of coverage before hiring you.

Texas Tip: Consider policies with limits of at least $1,000,000 per occurrence and $2,000,000 aggregate to adequately protect your business.

Workers' Compensation Insurance

Unlike many states, Texas doesn't legally require private employers to carry workers' compensation insurance. However, "going bare" (operating without workers' comp) exposes your roofing business to significant risk.

Roofing is consistently ranked among the most dangerous construction trades, with fall risks, heat exposure, and equipment hazards. Without workers' compensation:

- Injured employees can sue your business directly for medical costs and lost wages

- You'll lose important legal protections that limit your liability

- Many commercial and government contracts will be unavailable to you

Even though it's optional in Texas, workers' compensation insurance provides critical protection for roofing businesses with employees.

Commercial Auto Insurance

Texas law requires all vehicles to have minimum liability coverage of:

- $30,000 for bodily injury per person

- $60,000 per accident

- $25,000 for property damage

For roofing contractors regularly transporting crews, equipment, and materials, these minimums are rarely sufficient. Consider higher liability limits and additional coverages such as:

- Comprehensive coverage for damage from non-collision events (like hail)

- Collision coverage for accidents

- Tools and equipment coverage for items transported in vehicles

Commercial Property Insurance

Your business equipment represents a significant investment. Commercial property insurance protects your:

- Office space

- Warehouse facilities

- Tools and equipment

- Materials inventory

Given Texas's vulnerability to severe storms, ensure your policy includes adequate coverage for wind, hail, and flood damage.

Tools and Equipment Insurance

Specialized roofing equipment is expensive and vulnerable to theft, damage, and weather exposure. Tools and equipment insurance (sometimes called inland marine insurance) covers your gear when it's:

- In transit between job sites

- Stored at temporary locations

- Being used at a worksite

This coverage is particularly important in Texas, where job sites may be exposed to sudden severe weather.

Additional Coverage Options for Texas Roofers

Umbrella Insurance

An umbrella policy provides extra liability coverage beyond your standard policies. This supplemental coverage activates when primary policy limits are exhausted, offering an additional layer of protection.

For Texas roofers working on high-value properties or taking on larger commercial projects, umbrella policies provide affordable peace of mind.

Surety Bonds

While not insurance per se, surety bonds are often required for roofing contractors in certain Texas municipalities. These bonds guarantee that your work complies with local building codes and that you'll fulfill contractual obligations.

Requirements vary by location—for example, San Antonio requires a $25,000 bond for roofing contractors, while other municipalities may have different requirements.

Managing Insurance Costs for Texas Roofing Contractors

While comprehensive insurance is essential, there are strategies to manage costs:

- Bundle policies with the same carrier for multi-policy discounts

- Implement safety programs to reduce accident risks and potentially lower premiums

- Consider higher deductibles if your business has the cash reserves to handle them

- Work with insurance agents familiar with the roofing industry in Texas specifically

- Review coverage annually to ensure you're not over or under-insured

Choosing the Right Insurance Partner

When selecting insurance for your roofing business in Texas, look for carriers who:

- Specialize in construction or specifically roofing insurance

- Understand Texas's unique weather challenges and building codes

- Offer comprehensive packages designed for roofers

- Provide certificates of insurance quickly when needed for jobs

- Have responsive claims services

Conclusion: Protecting Your Roofing Business in the Lone Star State

Operating a successful roofing business in Texas requires balancing opportunity with risk management. Comprehensive insurance coverage tailored to the unique challenges of Texas roofing contractors provides the foundation for sustainable business growth.

By properly insuring your roofing business, you protect not only your assets and employees but also demonstrate professionalism to clients and general contractors—giving you a competitive edge in Texas's active roofing market.

Contact us today to review your current coverage and ensure your roofing business has the protection it needs to thrive in Texas's dynamic construction environment.