Instant Certificates of Insurance 24/7

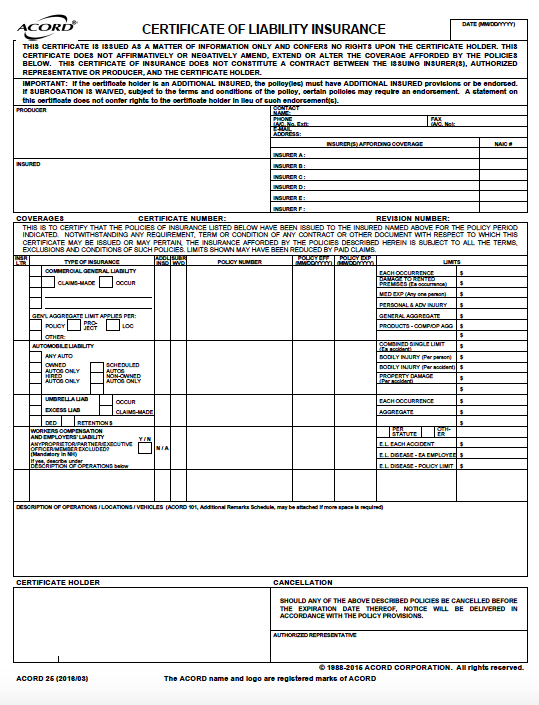

Did you know that we makes it possible for our customers to issue their own Certificates of Insurance at any time, from anywhere, 24/7? You will be able to add a holder to a specific certificate, generate the certificate for that holder, and print or save it accordingly.

Business Insurance For Roofing Contractors

Get The Attention You Need Today!

We know it takes a lot of time and it's not easy to shop for roofers insurance. Who really has the best coverage and rates? And who has time to call around from company to company, spending hours searching for the best coverage? We make the process simple again.

The Critical Importance of Commercial Insurance for Arizona Roofing Contractors

Arizona's unique climate and construction landscape present both opportunities and significant risks for roofing contractors. From intense summer heat that can exceed 120°F to sudden monsoon storms and occasional hail, the Grand Canyon State demands that roofing professionals operate with comprehensive commercial insurance coverage. Understanding and securing the right insurance protection isn't just a business necessity—it's the foundation of a sustainable and responsible roofing operation.

Understanding Arizona's Roofing Challenges

Arizona's extreme weather conditions create a demanding environment for roofing work. The state's intense UV radiation, thermal expansion and contraction cycles, and sudden weather changes can lead to unexpected complications during roofing projects. Additionally, Arizona's rapid population growth and construction boom mean roofing contractors are working on increasingly complex and valuable properties, amplifying the potential financial exposure from accidents or errors.

The state's regulatory environment also requires contractors to maintain specific insurance minimums for licensing, making proper coverage not just advisable but legally mandatory. Arizona's Registrar of Contractors mandates specific insurance requirements, and failure to maintain adequate coverage can result in license suspension or revocation.

Essential Insurance Coverage Types

General Liability Insurance

General liability insurance serves as the cornerstone of protection for Arizona roofing contractors. This coverage protects against third-party claims for bodily injury, property damage, and personal injury that may occur during roofing operations. In Arizona's litigious environment, where property values continue to rise and homeowners are increasingly aware of their rights, general liability coverage is absolutely essential.

This insurance typically covers incidents such as tools falling from roofs and damaging neighboring property, customers or visitors being injured on job sites, and accidental damage to the structures being worked on. Given Arizona's high property values, especially in areas like Scottsdale, Paradise Valley, and parts of Phoenix, even minor property damage claims can result in substantial financial exposure.

Workers' Compensation Insurance

Arizona law requires most employers to carry workers' compensation insurance, and roofing contractors are no exception. The roofing industry consistently ranks among the most dangerous occupations, with workers facing risks from falls, heat-related illnesses, electrical hazards, and equipment accidents. Arizona's extreme summer temperatures add an additional layer of risk, as heat exhaustion and heat stroke are serious concerns during the peak construction season.

Workers' compensation insurance provides medical coverage and wage replacement for employees injured on the job, while also protecting employers from most employee injury lawsuits. For roofing contractors operating in Arizona's challenging climate, this coverage is both a legal requirement and a practical necessity.

Commercial Auto Insurance

Roofing contractors typically operate fleets of vehicles to transport crews, equipment, and materials to job sites across Arizona's vast metropolitan areas. Commercial auto insurance provides coverage for vehicles used in business operations, including liability protection for accidents involving company vehicles and coverage for damage to the vehicles themselves.

Given the size and weight of roofing materials and equipment, accidents involving contractor vehicles can result in significant damage and liability. Arizona's extensive highway system and growing traffic congestion increase the likelihood of accidents, making comprehensive commercial auto coverage essential for protecting both the business and other road users.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects roofing contractors against claims arising from professional mistakes, oversights, or failure to deliver services as promised. This coverage is particularly important in Arizona, where building codes are stringent and evolving, and where contractors may be held liable for design flaws, improper installation, or failure to meet specified standards.

Arizona's extreme weather conditions mean that roofing failures can have severe consequences, potentially leading to significant water damage, mold issues, and structural problems. Professional liability insurance provides protection when clients claim that professional services were inadequate or failed to meet industry standards.

Arizona-Specific Insurance Considerations

Heat-Related Risks

Arizona's extreme summer temperatures create unique risks that contractors in other states may not face. Heat-related illnesses among workers are a significant concern, and insurance policies should account for the increased medical costs and workers' compensation claims that may arise from these conditions. Contractors should work with insurers who understand these regional risks and can provide appropriate coverage limits.

Monsoon Season Challenges

Arizona's monsoon season brings sudden, intense storms that can create dangerous working conditions and increase the likelihood of accidents. Strong winds, lightning, and flash flooding can turn routine roofing work into hazardous situations. Insurance coverage should account for these seasonal risks and the potential for weather-related claims.

Regulatory Compliance

Arizona's Registrar of Contractors requires specific insurance minimums for licensing, and these requirements can change. Contractors must ensure their coverage meets or exceeds state requirements and stays current with any regulatory updates. Working with an insurance provider familiar with Arizona's licensing requirements is essential for maintaining compliance.

Choosing the Right Coverage Limits

Assessing Your Risk Exposure

Determining appropriate coverage limits requires a thorough assessment of your business's risk exposure. Factors to consider include the size and value of projects typically undertaken, the number of employees, the types of roofing work performed, and the geographic areas served. Arizona contractors working on high-value commercial properties or luxury residential projects may need higher limits than those focusing on basic residential repairs.

Industry Standards and Client Requirements

Many commercial clients and general contractors require specific insurance minimums before awarding contracts. These requirements often exceed state minimums and may include specific coverage types or limits. Contractors should review their typical client requirements and ensure their insurance portfolio meets these standards to avoid losing business opportunities.

Financial Protection Strategies

Insurance limits should be sufficient to protect the business's assets and future earnings. A single major claim can devastate an under-insured contractor, making it essential to balance premium costs with adequate protection. Consider the potential cost of worst-case scenarios, including major property damage, serious injuries, or professional liability claims.

Working with Insurance Professionals

Specialized Roofing Insurance Providers

Not all insurance providers understand the unique risks facing roofing contractors, particularly in Arizona's challenging environment. Working with insurers who specialize in construction and roofing coverage ensures that policies are tailored to your specific risks and that claims are handled by professionals who understand the industry.

Regular Coverage Reviews

The roofing industry and insurance landscape are constantly evolving, making regular coverage reviews essential. Annual policy reviews should assess whether coverage limits remain appropriate, whether new risks have emerged, and whether more cost-effective options are available. Changes in business operations, such as expanding into new services or geographic areas, may require coverage adjustments.

Claims Management and Prevention

Effective insurance management goes beyond simply purchasing coverage. Implementing robust safety programs, maintaining detailed documentation, and having clear procedures for reporting claims can help minimize losses and keep insurance costs manageable. Many insurers offer risk management resources and may provide premium discounts for contractors who demonstrate commitment to safety and loss prevention.

The Bottom Line

For Arizona roofing contractors, comprehensive commercial insurance coverage represents far more than a regulatory requirement—it's a strategic business investment that protects against the unique risks of operating in one of America's most challenging climates. From the scorching summer heat to sudden monsoon storms, from high-value properties to stringent building codes, Arizona presents risks that demand thoughtful, comprehensive insurance protection.

The cost of adequate insurance coverage is minimal compared to the potential financial devastation of operating without proper protection. In Arizona's litigious environment and extreme weather conditions, the question isn't whether you can afford comprehensive insurance—it's whether you can afford to operate without it. Smart contractors recognize that proper insurance coverage isn't just about compliance; it's about building a sustainable business that can weather any storm, literal or figurative.